Depreciation Expense Of Office Furniture Is Considered As . Let’s take a look at all three business expense categories and. Say your business bought $2,000 worth of office furniture and started using it may 1. the basic journal entry for depreciation is to debit the depreciation expense account (which appears in the. You generally can't deduct in one year the entire cost of property you acquired, produced, or. here’s how it works under the normal rules: real property is 39 year property, office furniture is 7 year property and autos and trucks are 5 year property. here’s where things get a little tricky: is a calculator considered office supplies or office equipment? See publication 946, how to depreciate property. While office furniture is typically classified as an asset on the balance sheet, its depreciation over time.

from einvestingforbeginners.com

here’s how it works under the normal rules: is a calculator considered office supplies or office equipment? You generally can't deduct in one year the entire cost of property you acquired, produced, or. See publication 946, how to depreciate property. Say your business bought $2,000 worth of office furniture and started using it may 1. real property is 39 year property, office furniture is 7 year property and autos and trucks are 5 year property. the basic journal entry for depreciation is to debit the depreciation expense account (which appears in the. While office furniture is typically classified as an asset on the balance sheet, its depreciation over time. here’s where things get a little tricky: Let’s take a look at all three business expense categories and.

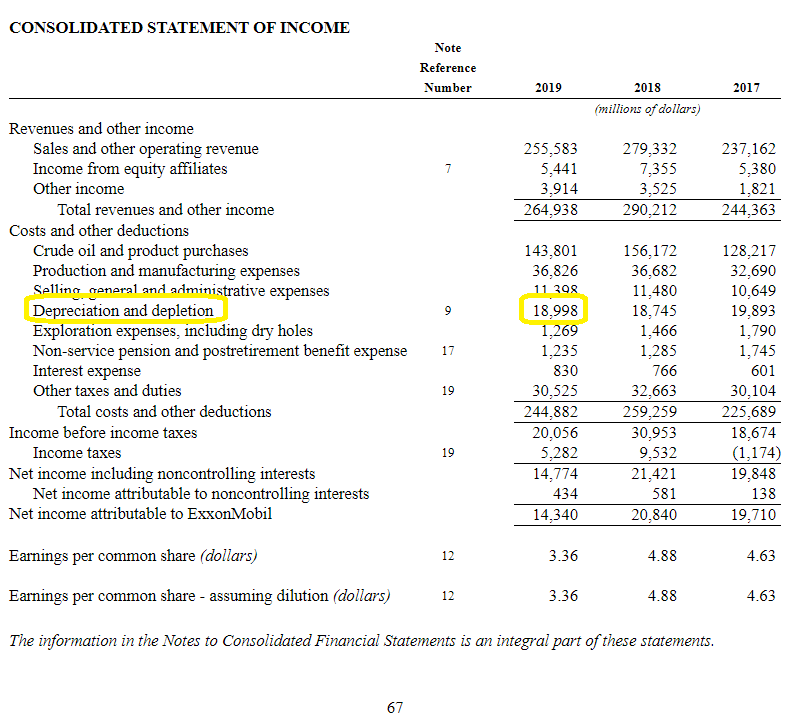

Is Depreciation an Expense? Is EBITDA Deceitful? Well, it Depends

Depreciation Expense Of Office Furniture Is Considered As Let’s take a look at all three business expense categories and. See publication 946, how to depreciate property. Say your business bought $2,000 worth of office furniture and started using it may 1. Let’s take a look at all three business expense categories and. the basic journal entry for depreciation is to debit the depreciation expense account (which appears in the. You generally can't deduct in one year the entire cost of property you acquired, produced, or. is a calculator considered office supplies or office equipment? here’s where things get a little tricky: While office furniture is typically classified as an asset on the balance sheet, its depreciation over time. real property is 39 year property, office furniture is 7 year property and autos and trucks are 5 year property. here’s how it works under the normal rules:

From www.chegg.com

Depreciation Expense Building Depreciation Expense Depreciation Expense Of Office Furniture Is Considered As See publication 946, how to depreciate property. You generally can't deduct in one year the entire cost of property you acquired, produced, or. here’s how it works under the normal rules: real property is 39 year property, office furniture is 7 year property and autos and trucks are 5 year property. here’s where things get a little. Depreciation Expense Of Office Furniture Is Considered As.

From www.educba.com

Depreciation Expenses Formula Examples with Excel Template Depreciation Expense Of Office Furniture Is Considered As You generally can't deduct in one year the entire cost of property you acquired, produced, or. Let’s take a look at all three business expense categories and. See publication 946, how to depreciate property. is a calculator considered office supplies or office equipment? real property is 39 year property, office furniture is 7 year property and autos and. Depreciation Expense Of Office Furniture Is Considered As.

From learnaccountingskills.com

How to Calculate Depreciation Expense Straight Line Method Depreciation Expense Of Office Furniture Is Considered As See publication 946, how to depreciate property. here’s how it works under the normal rules: Say your business bought $2,000 worth of office furniture and started using it may 1. real property is 39 year property, office furniture is 7 year property and autos and trucks are 5 year property. You generally can't deduct in one year the. Depreciation Expense Of Office Furniture Is Considered As.

From www.youtube.com

How to prepare depreciation schedule in excel YouTube Depreciation Expense Of Office Furniture Is Considered As Say your business bought $2,000 worth of office furniture and started using it may 1. See publication 946, how to depreciate property. here’s how it works under the normal rules: the basic journal entry for depreciation is to debit the depreciation expense account (which appears in the. While office furniture is typically classified as an asset on the. Depreciation Expense Of Office Furniture Is Considered As.

From haipernews.com

How To Calculate Depreciation Expense Accounting Haiper Depreciation Expense Of Office Furniture Is Considered As here’s where things get a little tricky: While office furniture is typically classified as an asset on the balance sheet, its depreciation over time. here’s how it works under the normal rules: See publication 946, how to depreciate property. Let’s take a look at all three business expense categories and. the basic journal entry for depreciation is. Depreciation Expense Of Office Furniture Is Considered As.

From www.superfastcpa.com

What is Depreciation Expense? Depreciation Expense Of Office Furniture Is Considered As here’s where things get a little tricky: Say your business bought $2,000 worth of office furniture and started using it may 1. is a calculator considered office supplies or office equipment? real property is 39 year property, office furniture is 7 year property and autos and trucks are 5 year property. here’s how it works under. Depreciation Expense Of Office Furniture Is Considered As.

From go-green-racing.com

Furniture And Fixtures Depreciation online information Depreciation Expense Of Office Furniture Is Considered As You generally can't deduct in one year the entire cost of property you acquired, produced, or. is a calculator considered office supplies or office equipment? here’s how it works under the normal rules: the basic journal entry for depreciation is to debit the depreciation expense account (which appears in the. Say your business bought $2,000 worth of. Depreciation Expense Of Office Furniture Is Considered As.

From slidetodoc.com

LESSON Learning Objectives 19 3 Journalizing Depreciation Expense Depreciation Expense Of Office Furniture Is Considered As here’s where things get a little tricky: the basic journal entry for depreciation is to debit the depreciation expense account (which appears in the. See publication 946, how to depreciate property. Say your business bought $2,000 worth of office furniture and started using it may 1. is a calculator considered office supplies or office equipment? You generally. Depreciation Expense Of Office Furniture Is Considered As.

From businessyield.com

DEPRECIATION ACCOUNTING Definition, Methods, Formula & All you should know. Depreciation Expense Of Office Furniture Is Considered As Let’s take a look at all three business expense categories and. here’s where things get a little tricky: Say your business bought $2,000 worth of office furniture and started using it may 1. See publication 946, how to depreciate property. You generally can't deduct in one year the entire cost of property you acquired, produced, or. is a. Depreciation Expense Of Office Furniture Is Considered As.

From www.chegg.com

Solved Chapter 10 Serial Problem Part 1 Annual Depreciation Depreciation Expense Of Office Furniture Is Considered As See publication 946, how to depreciate property. is a calculator considered office supplies or office equipment? the basic journal entry for depreciation is to debit the depreciation expense account (which appears in the. While office furniture is typically classified as an asset on the balance sheet, its depreciation over time. Say your business bought $2,000 worth of office. Depreciation Expense Of Office Furniture Is Considered As.

From www.chegg.com

Solved Depreciation expense (office furniture and equipment) Depreciation Expense Of Office Furniture Is Considered As See publication 946, how to depreciate property. Let’s take a look at all three business expense categories and. here’s where things get a little tricky: You generally can't deduct in one year the entire cost of property you acquired, produced, or. real property is 39 year property, office furniture is 7 year property and autos and trucks are. Depreciation Expense Of Office Furniture Is Considered As.

From www.slideshare.net

Depreciation Depreciation Expense Of Office Furniture Is Considered As While office furniture is typically classified as an asset on the balance sheet, its depreciation over time. Say your business bought $2,000 worth of office furniture and started using it may 1. is a calculator considered office supplies or office equipment? here’s where things get a little tricky: Let’s take a look at all three business expense categories. Depreciation Expense Of Office Furniture Is Considered As.

From www.chegg.com

Solved Depreciation expense (office furniture and equipment) Depreciation Expense Of Office Furniture Is Considered As here’s how it works under the normal rules: real property is 39 year property, office furniture is 7 year property and autos and trucks are 5 year property. here’s where things get a little tricky: You generally can't deduct in one year the entire cost of property you acquired, produced, or. the basic journal entry for. Depreciation Expense Of Office Furniture Is Considered As.

From www.coursehero.com

[Solved] . Depreciation expense (office furniture and equipment)... Course Hero Depreciation Expense Of Office Furniture Is Considered As is a calculator considered office supplies or office equipment? the basic journal entry for depreciation is to debit the depreciation expense account (which appears in the. here’s where things get a little tricky: here’s how it works under the normal rules: Say your business bought $2,000 worth of office furniture and started using it may 1.. Depreciation Expense Of Office Furniture Is Considered As.

From dxoszpqpo.blob.core.windows.net

In Cost Sheet Depreciation Of Office Furniture Is Included In at Dana Peterson blog Depreciation Expense Of Office Furniture Is Considered As is a calculator considered office supplies or office equipment? You generally can't deduct in one year the entire cost of property you acquired, produced, or. Let’s take a look at all three business expense categories and. the basic journal entry for depreciation is to debit the depreciation expense account (which appears in the. While office furniture is typically. Depreciation Expense Of Office Furniture Is Considered As.

From judithdiyah.blogspot.com

Calculate depreciation of furniture JudithDiyah Depreciation Expense Of Office Furniture Is Considered As Say your business bought $2,000 worth of office furniture and started using it may 1. is a calculator considered office supplies or office equipment? See publication 946, how to depreciate property. real property is 39 year property, office furniture is 7 year property and autos and trucks are 5 year property. here’s where things get a little. Depreciation Expense Of Office Furniture Is Considered As.

From youngandtheinvested.com

MACRS Depreciation, Tables, & Method (All You Need to Know!) Depreciation Expense Of Office Furniture Is Considered As here’s how it works under the normal rules: You generally can't deduct in one year the entire cost of property you acquired, produced, or. See publication 946, how to depreciate property. here’s where things get a little tricky: is a calculator considered office supplies or office equipment? the basic journal entry for depreciation is to debit. Depreciation Expense Of Office Furniture Is Considered As.

From standorsit.com

Do You Know Your Office Furniture Depreciation Rate? Depreciation Expense Of Office Furniture Is Considered As You generally can't deduct in one year the entire cost of property you acquired, produced, or. here’s how it works under the normal rules: While office furniture is typically classified as an asset on the balance sheet, its depreciation over time. Let’s take a look at all three business expense categories and. the basic journal entry for depreciation. Depreciation Expense Of Office Furniture Is Considered As.